Indonesia

New Regulation Related to CG in IFI’s (2014): Will It Solve the Existing

Challenge and Issue

RAHMA SUCI SENTIA

Abstract

The issue

of islamic corporate governance (CG) is very crucial given its central role in

islamic financial institution (IFI)’s development. The rapid increase in the

Indonesian IFI, especially banking and good support from government as

regulator (Bank Indonesia and OJK), over the years has triggered a question

whether its corporate governance has improved respectively. To answer this, the

good corporate governance (GCG) indicator based on AAOFI, IFSB, other benchmark

country framework (BNM), research papers are used. Furthermore, it is complimented

by deeper analysis on the ability the newest Indonesia CG guideline (OJK

Regulation No.8/POJK.03/2014) to tackle the existing CG issue and challenge in

islamic perspective. It is hoped

that this paper will encourage OJK and IFI in Indonesia to develop more sound

and comprehensive CG especially in term sharia governance.

Keywords: Good Corporate Governance, Sharia Governance, Indonesia, OJK Regulation,

Islamic Financial Institution, Islamic Bank

1.

Introduction

The issue of CG in IFI has been a long interest of

the world scholars. Research on the topic have been done in analytical as well

as in its technical aspect.

CG has main functions: to assurance the existence of

‘TARIF’ (Transparency, Accountability, Responsibility, Independence, and

Fairness) in company. It is aimed to ensure the interest of all stakeholder. CG also can be tool to influence the

performance of corporation. In islamic context, comprehensive islamic

compliance make confidence to the public and the financial market on the

credibility of Islamic finance operations.

The responsibility to develop GCG not solely in the

hand of Board or Supervisory Sharia Board only, rather, participation from the

employee as well as customer are highly needed, nonetheless,

enforcement from regulator is very crucial in this effort.

In 2014, Financial Service Regulatory in Indonesia

(OJK) published new regulation related to the soundness of islamic bank, that

cover the GCG framework in islamic bank. However the question remains: Is the

new regulation in IFI followed by its comprehensive GCG? Has the current GCG run

its role properly (check and balance the shariah along the procedure)? In this

paper, the indicator GCG in islamic perspective will be elaborated, followed by

assessment of Indonesia’s CG issue and challenge, and closed by conclusion.

2.

Good

Corporate Governance in Islamic Perspective and Its Indicator

There are several CG Guideline/Framework in islamic

perspective (AAOFI, IFSB, BNM SGF) and many paper has published and moreover

recently aftermath of the financial crisis 2008-2009. There is no single

definition of GCG in islamic perspective; however the same notions of GCG is

shared among many scholar and framework.

The GCG is said to be sustainable if there is sustainable

process to check and balance the system, procedure in company as generally, or

the sharia compliance in IFI especially. In another words, GCG in islamic perspective

consider the creation of enabling environment by strengthening market

discipline in the financial sector, moral integrity as well as users of fund,

an appropriate social-political environment with equitably enforced legal and

institutional check to ensure the fulfilment of contract and promises (Chapra,

2002). Thus, the ability of IFI to maintain and improve the shariah procedure

in the long term, without jeopardising can be categorized as Good Corporate Governance.

The goal of GCG is to avoid unjust among stakeholder.

In regards, the indicator of GCG, its indicator

seems to be convergent, that is the existence of Shariah Board as one of indicator.

In

many research paper, such as Chapra (2002) discussed the indicator that need to

be taken is to make the Board and the Management more effective and accountable

in the performance of their role and to enable the shareholders and depositors

to play a greater role in protecting their interest. Although the latest

indicator is significance but it is quite similar to conventional concept.

However recently, the existence of sharia risk, sharia

audit, sharia review function, are mainly used as indicator GCG, for example,

by BNM[1]

and State Bank of Pakistan[2].

It is obvious that Sharia governance

is the priority today. Some regulators concern to build on sharia based with

corporate governance best practice and enact specific regulations or guideline

for the different sector of the industry for as systematic development (IFDR,

2014).

Moreover, some recent research show that Sharia

Governance indicator have impacted to IFI, for example:

·

Ramli (2015) show the impact of the issuance of the Shariah Governance

Framework (SGF) by the Central Bank of Malaysia in 2011. The result shows that

based on disclosure of Annual Report, The BOD and SSB show the higher

disclosure, followed by Sharia Risk Management, Sharia Audit, Management,

Internal Sharia Reviewer, Sharia Secretariat, and Sharia Research respectively.

It has indicated the importance of CG and SG framework to encourage good

governance practices in relation to Sharia matters by Islamic financial

institutions (IFIs).

·

Shafii (2013) found recent issuance of Shariah Governance Framework by

Bank Negara Malaysia has shown a significant impact towards the establishment

of the Shariah audit and consequently, towards the role of the Shariah

Committee, particularly on the knowledge of the implementation process of the

product in the organization and the internal control that should be imposed.

It is better to conclude that GCG definition and

indicator in islamic perspective is wider than general CG concept in

conventional.

3.

Assessment

on IFIs GCG in Indonesia

3.1

Indonesia’s

GCG is still based on Shariah Board

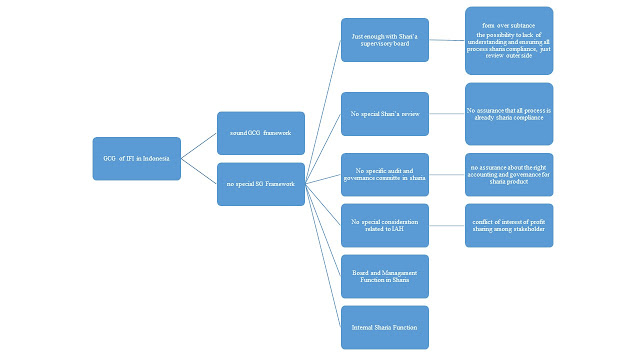

Figure

1: The Current Indonesia GCG Guideline to Islamic Bank

Source: OJK

Letter No 10/SEOJK.03/2014, processed by author

Based

on the OJK new regulation, here is the GCG framework which is applied by IFI (limited

to islamic banks only). From the figure above we can see that Indonesia’s CG

consisted of General framework (quite similar to conventional) with additional

points about SSB and sharia compliance in funding and financing. The newest

just consider GCG assessments as an integral part to assessment the soundness

of islamic bank. Compared to previous regulation in 2010, actually there is

no significance change in GCG guideline for islamic bank in Indonesia.

Figure 2: Development Process of GCG Guideline to Islamic Bank in

Indonesia

Source: OJK Website, processed by author

The

previous research which examined the GCG using the previous regulation 2010

found that there was still lack of GCG in IFI especially related to its nature

(islamic perspective). The research of Darmadi (2011) and Siswantoro (2011) showed

that top three disclosure and focus in Islamic commercial bank were still BOC, BOD[3],

and Supervisory Sharia Board(SSB). As the newest regulation is quite similar to

previous, will the future GCG be better to tackle the issue and challenge CG in

islamic perspective?

Otherwise, the trend of Indonesia’s CG value in

global islamic finance is enough satisfying. Indonesia is

the top ten GCG. Between 2013 and 2014, there is an increase in CG value from

30 point to 47, 6 (IFDR, 2014). Not like other SSB that facing issue related to

independence of SSB, SSB in Indonesia is most likely independence. Their

responsibilities is limited to ask the explanation from IFI, cross check fatwa

used, review SOP, exam the sample. Fatwa shopping is not main issue because

fatwa is made by National Sharia Board in Islamic Council (independent

institution). Moreover, their fatwa is not binding until OJK published the

regulation that accept the fatwa in islamic finance product.

The fact above can explain why Indonesia’s GCG can

be categorized, to some extent, as good. When most of countries which

experience islamic finance growing problem may face the ‘fatwa shop’, Indonesia

may be able to tackle it.

3.2

Issue

Break Down: Going Beyond Supervisory Shariah Board to Shariah Function

It seems to be early to conclude Indonesia IFI is in

a good shape, besides, in academic, it is good to be prepared for the worst.

There is possibility that the problem in Indonesia’s is hidden, which means it cannot

be seen from the existence qualified Shariah Board. One possibility is that problem

might be in the no existence length arm in shariah function and the lack of comprehensive

regulation. There are two main reason why we have to look to this point.

First, the existence of Shariah Function can give

sign how consistency one company is to prevent non-sharia compliance problem in

operation. Sharia function should be from external side e.g. audit committee in

sharia principle and also from internal side e.g. internal sharia review. An

IFI which do not provide significant structure on sharia function could face

unfavourable condition when they build more comprehensive product. Beside that

it can give sign whether the check and balance has been realized or not.

Second, the existence of framework from regulator

can enforce the IFI to establish more sound CG. At least, IFI will fulfil the

minimum requirement CG from regulator. Based on the history, Indonesia’s CG in

islamic bank was not good before the existence of regulation. If there is law

enforcement from regulator, the IFI may be encouraged to establish good CG in

their internal company. For instance, Siswantoro

(2010) researched that the BSM’s risk management committee did not consist of

an independent commissioner in 2007. However, in the following year after

regulation, it was CG compliance. Moreover, in 2010 (after the second regulation)

all islamic bank complied with the regulation. There is trend that after the

regulation, there was an increase in implementing CG in islamic bank..

These two main possibility problem clearly cannot be

solved through the newest OJK regulation. The multiple analysis is done by

compared the newest Indonesia regulation to other framework (AAOFI, IFSB, and

other benchmark country framework) to find the CG potential issue that may

exist in Indonesia. Here is the problem breakdown.

Source: Author Analysis

(OJK Regulation compared to CG proposed

IFSB 3,6,8,10; AAOFI; BNM Framework. See further comparison in appendix 3)

From the figure

above, it can be concluded that Sharia Governance is still not become Indonesia

focus in establishing the Good Corporate Governance. The failure of existence

of Sharia Governance guideline create the failure of Comprehensive Sharia

Function in IFI.

1. Limited Supervisory Sharia Board (SSB)

Ability

The

problem that still exists on SSB in Indonesia is whether the

SSB is expected to have sufficient knowledge on finance in general and Islamic

finance in particular. Moreover, in formal structure, SSB become the only man

behind to ensure the sharia compliance. However, it is fact that there is a

limit of ability to understand and ensure all process sharia compliance if it

just is done by SSB team itself only.

2.

No existence of Sharia Review

Sharia

review work which involve planning, designing, executing, preparing and

reviewing will assist the work process

of SSB in forming and expressing opinions on the extent of Shariah

compliance. The failure of its

existence means the failure to form strong and independence basis of SSB's

report in institutional annual financial report.

3. No existence of specific audit and

governance committee

In

Indonesia, there is just three committees which supervise islamic bank: audit,

risk management and remuneration and nomination. They also do not have special

duty related to sharia rule.

4. No special consideration related to IAH

(Investment Account Holder)

In term of

possibility of conflict of interest between IAH and shareholder, it is very

obvious in Indonesia. In banking, the percentage

of liability account (depositor) is bigger than shareholder. Moreover, the

portion of mudharabah account (IAH) in Indonesia is big which show IAH has

special room in islamic banking business.

5. The low enforcement to Board and

Management to enhance their sharia capacity

The question is ‘Are the Board and

the Management expected to have reasonable understanding on Shariah

principles?’ Board and management should be sensitive to the issue of

non-sharia compliance, and it is just possible if there is a responsible to

fulfil the minimum understanding of sharia principle. With such minimum

capability, it seems to be possible for top management to implement ‘tone at

the top[4]’

in their working place and encourage their employee to aware to sharia aspect

in their business too.

6. No existence of the Sharia Compliance

Function in Internal IFI

1) The failure to conduct internal Shariah

review on a continuous basis

The internal review/control system in

term of sharia is not really run. The current sharia review rely on the sharia

board, and it cannot guarantee all aspect is really followed the sharia

procedure. However, in tem of regulation, Indonesia does not have specific

regulation that encourage company should provide specialist internal. The

failure to implement this may lead to failure to exam and evaluate the extent

of company's compliance to sharia.

2) No existence of independent Shariah Audit

function to undertake regular Shariah audit on annual basis.

In term auditing, the numbers of follow

up upon sharia audit funding are still low. Regulation do not give special mandate

in IFI related to sharia audit nature. The problem will exist, for example,

when there is the wrong accounting in IFI that cause the product become not

sharia compliance. The lack of understanding of sharia make the accountant may

not consider it and sharia internal auditor should tackle that issue. Some

cases in Indonesia related to false in accounting is found at the end by

regulator (OJK), not by the internal audit or audit committee.

Good general CG framework is not enough to guarantee

the better CG in IFI. The solution is to establish the SG framework which

enforce IFI to effectively provide the check-balance organ, or function in

their organization. The clearly indicated that their major challenges of

implementing effective shariah governance are due to lack of expertise and resources.

However, the existence of clear sharia framework will encourage industry,

education centre, and human resource themselves to fulfil the requirement. Indonesia can take lesson from Malaysia, although the sharia function

is still not fully implemented, the SGF framework has encouraged industry to fulfil

the sharia function standard step by step.

4.

Conclusion

Good corporate governance of IFI in Indonesia is not

able to only depend on the existence of a competent Sharia Board and islamic

compliance principle in funding and financing. It should be upon a reliable whole function in

checking and balance any possible issue in day to day monitoring. This analysis

paper, however has limitation. This paper only focuses on analysing the

existing regulation in tackling the existing issue and challenge on GCG. Hence

it may not reflect the actual issue and challenge in practice. However this

paper gives suggestion to regulator to establish more clearly framework related

to sharia nature in IFI.

References

AAOFI-Governance

and Auditing Standards. (2012). 4 Annual IIBI-ISRA Thematic Workshop. London,

United Kingdom

A Comparative Analysis of Shari’ah

Governance in Islamic Banking Institutions across Jurisdictions (2013). ISRA Research Paper

Besar, Mohd Hairul Azrin Haji.

Sukor, Mohd Edil Abd. Muthalib, Nuraishah Abdul & Gunawa, Alwin Yogaswara.

The Practice of Shariah Review as Undertaken by Islamic Banking Sector in

Malaysia. Malaysia

Chapra, MU. Ahmed, H. (2002).

Corporate Governance in Islamic Financial Institutions. Islamic Research and

Training Institute (IRTI). Jeddah.

Darmadi, Salim. (2011). Corporate

Governance Disclosure in the Annual Report: An Exploratory Study on Indonesian

Islamic Banks. http://ssrn.com/abstract=1956254

Alwyni, Farouk Abdullah. (2015).

Corporate governance in global Islamic financial institutions. Islamic Finance News. Accessed July

2015

IFDR (Islamic

Finance Development Report). (2014). ICD Thomson Reuters

International Federation of Accountants. (2007). Tone at The Top

and Audit Quality

Malik, Muhammad Shaukat. Malik, Ali

& Mustafa, Waqas. (2011). Controversies that make Islamic banking

controversial: An analysis of issues and challenges. American Journal of

Social and Management Sciences

PBI No 11/33/PBI/2009 Tentang

Pelaksanaan Good Corporate Governance Bagi Bank Umum Syariah dan Unit Usaha

Syariah

POJK No 8/POJK.03/2014 Tentang

Penilaian Tingkat Kesehatan Bank Umum Syariah dan Unit Usaha Syariah

POJK No 18/POJK.03/2014 Tentang

Penerapan Tata Kelola Terintegrasi Bagi Konglomerasi Keuangan

Ramli, N.M. Majid, A.S.A. Muhamed,

N.A.M. & Yaakub N.A (2015) Shariah Governance Disclosure Index and

Institutional Ownership of Islamic Financial Institutions in Malaysia.Journal

of Islamic Finance and Business Research.Vol. 3. No. 1. March 2015 Issue.

Pp. 1 – 13

Shafii, Zurina. Abidin, A.Z.

Salleh,Supiah. Jusoff, K. & Kasim,N. (2013). Post Implementation of Shariah

Governance Framework: The Impact of Shariah Audit Function towards the Role of

Shariah Committee. Middle-East Journal of Scientific Research 13

SEOJK No 10/SEOJK.03/2014 Tentang

Penilaian Tingkat Kesehatan Bank Umum Syariah dan Unit Usaha Syariah

Siswantoro, Dodik (2012). A Critique

of Islamic Banks Good Corporate Governance Report in Indonesia. Journal of

Islamic Business and Management Vol.2 No.2, 2012

Sulaiman, Maliah. Majid, N.A. &

Ariffin, N.M. (2015). Corporate Governance of Islamic Financial Institutions in

Malaysia. Volume 4 Ethics, Governance and Regulation in Islamic Finance. ISBN: 978-9927-118-24-1

Appendix 1: Governance Framework for Shariah Compliance for IFIs

Source: Omar Mustafa Ansari (E&Y)

Appendix 2: Key Sharia Function

Model

Source:

Dr Hurriyah El Islamy (CIMB Group), 2015

Appendix

3: AAOFI, IFSB, BNM, OJK CG Framework/Guideline

|

AAOFI

|

IFSB

|

BNM

|

OJK

|

|

SSB: Appointment,

Composition, Report

|

General Governance Approach of IIFS

|

Board structure and

functioning

|

BOC

|

|

Sharia Review

|

Rights of Investment Account Holders (IAH)

|

Nominating committee

|

BOD

|

|

Internal Sharia Review

|

Compliance with Islamic Shariah rules and principles

|

Remuneration committee

|

Committee

|

|

Audit and Governance

Committee (Including Related to Sharia Principle)

|

Transparency of financial reporting in respect of investment accounts

|

Risk management committee

|

Supervisory Sharia Board

(SSB)

|

|

Independence of Sharia Board

|

|

Audit committee/audit and

governance committee

|

Sharia Compliance in Funding

and Financing

|

|

Statement for Governance

Principle for IFIs

|

|

SSB

|

Conflict of Interest

|

|

Corporate Social

Responsibility

|

|

Risk management

|

Compliance

|

|

|

|

Internal audit and control

|

Internal Audit

|

|

|

|

Related parties transaction

|

External Audit

|

|

|

|

Management report

|

Limited Fund in Financing

|

|

|

|

Non-adherence to guidelines

|

Transparency, GCG Report, and

Internal Report

|

|

|

|

Customers/investment account

holder

|

|

|

|

|

Governance committee (related

to Sharia)

|

|

|

|

|

Shariah compliance

|

|

Source:

AAOFI, IFSB, BNM SGF, processed

[1] Bank Negara Malaysia

(BNM) Shari'ah Governance Framework for

Islamic Financial Institutions was

published in 2010

[2]

State Bank of Pakistan (SBP) Shariah Governance Framework for Islamic

Banking Institutions was published in April

2014.

[3] The Board of Directors in the context of Indonesia’s two-tier board

system is absolutely different from that in the unitary system. The BOD in

Indonesian firms is equal to top management in unitary board systems

[4]

Tone at the top is the ultimate responsibility of the organization’s leadership

– lead from the top by giving consistent messages on the importance of quality (International Federation of Accountants, 2007). In the contexof this

paper, the quality is refer to sharia compliance.

Tidak ada komentar:

Posting Komentar